Dr Debesh Roy, Chairman, InsPIRE

The Reserve Bank of India (RBI) retained its accommodative stance and kept policy rates unchanged in its latest monetary policy announced on 8 October 2021. However, the beginning of normalisation of policy stance by halting its bond-buying efforts, was evident.

The six-member Monetary Policy Committee (MPC), headed by Governor Shaktikanta Das, unanimously decided to retain the policy repo rate at 4% and the reverse repo rate 3.35%. However, all members, except one, voted to continue with the accommodative stance as long as necessary to revive and sustain growth on a durable basis and mitigate the impact of Covid-19 on the economy, while ensuring that inflation remains within the target going forward. The Governor made it clear: “We do realise that as we approach the shore; when the shore is so close, we don’t want to rock the boat because we realise there is a life, there is a journey beyond the shore”.

However, the RBI decided to suspend the Government Securities Acquisition Programme (G-SAP), the Indian version of Quantitative Easing (QE) of the US. Through the G-SAP, RBI has injected INR 2.2 trillion (USD 29.3 billion) of liquidity in the system [out of the total INR 2.37 trillion (USD 31.5 billion) injected through bonds], during the first six months of 2021-22. The central bank would absorb a higher quantum of liquidity gradually through its 14-day variable rate reverse repo (VRRR) auctions, from the current INR 4 trillion (USD 53.2 billion) to INR 6 trillion (USD 79.9 billion) in stages, by December 2021.

The Governor justified the suspension of G-SAP by stating: “Given the existing liquidity overhang, the absence of a need for additional borrowing for GST compensation and the expected expansion of liquidity in the system as Government spending increases in line with budget estimates, the need for undertaking further G-SAP operations at this juncture does not arise. The Reserve Bank, however, would remain in readiness to undertake G-SAP as and when warranted by liquidity conditions and also continue to flexibly conduct other liquidity management operations including Operation Twist (OT) and regular open market operations (OMOs)”.

Deputy Governor Michael D. Patra explained that RBI is still in passive liquidity mode and was accepting what the market was offering, and that the central bank aims to move to an active mode of liquidity management.

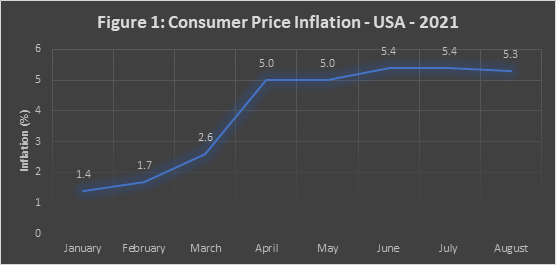

The RBI sharply moderated the outlook for CPI inflation during 2021-22 from 5.7% projected in the previous MPC meeting (04-06 August 2021) to 5.3%, due to easing of food prices, combined with favourable base effects. However, prices of crude oil which will remain volatile over uncertainties on the global supply and demand conditions, rising metals and energy prices, acute shortage of key industrial components and high logistics costs are adding to input cost pressures. The inflation projection for Q2 FY2021-22 was reduced from 5.9% to 5.1%; and 5.3% to 4.5% in Q3. The inflation projection, however, remained the same at 5.8% for Q4. The risks continued to remain broadly balanced. The inflation projection for Q1 2022-23 was raised from 5.1% to 5.2%.

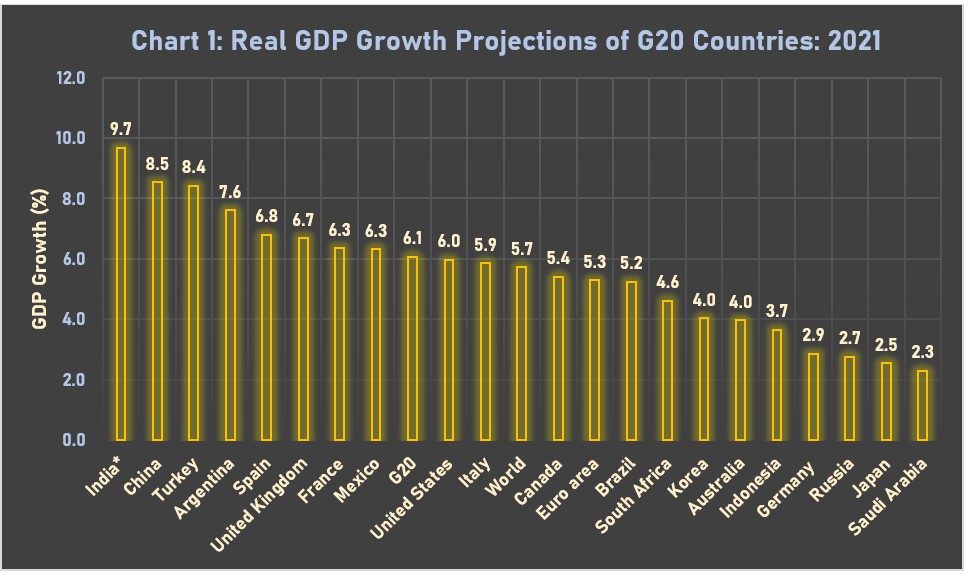

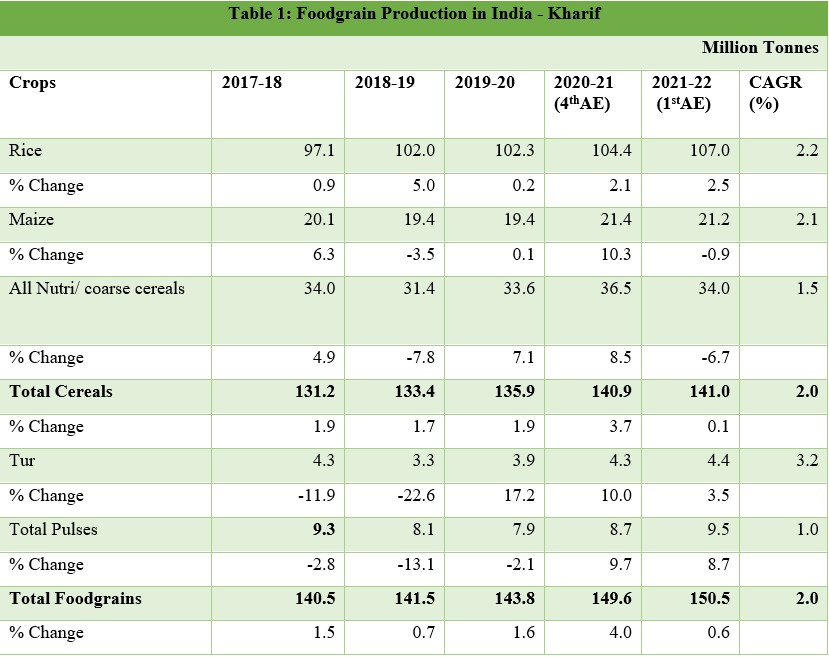

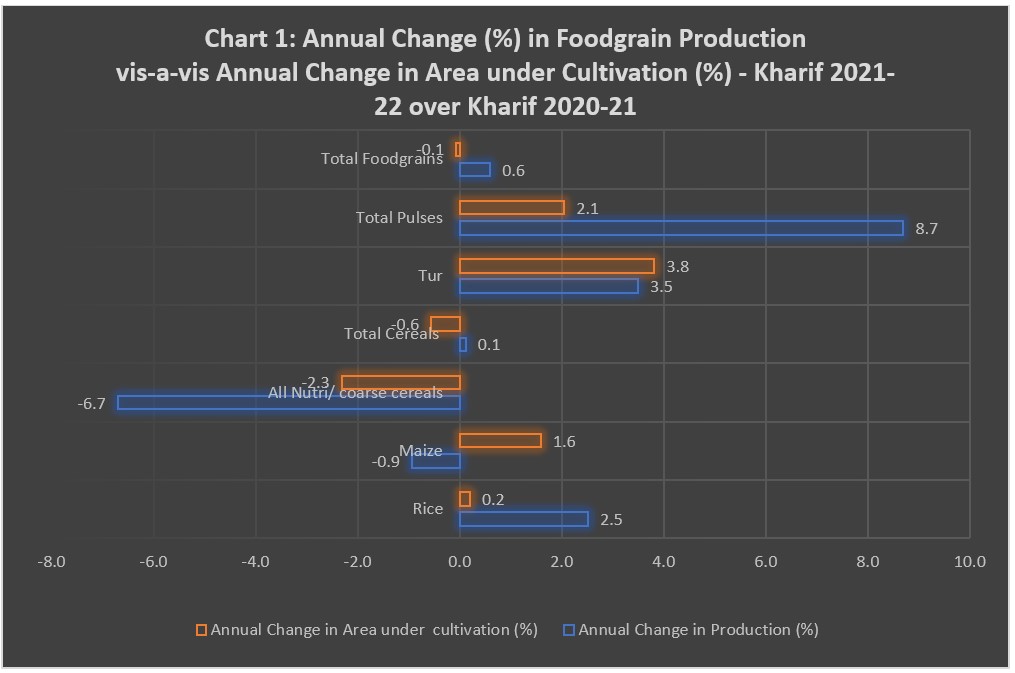

Projection for India’s GDP growth rate by the MPC was at 9.5%, which was same as the previous projection. Domestic economic activity is expanding with the weakening of the second covid wave. With favourable prospects for kharif and rabi crops, rural demand is expected to be buoyant. Significant increase in the pace of vaccination and the forthcoming festival season, are expected to support a rebound in the pent-up demand for contact intensive services, and boost growth. Easy monetary and financial conditions would also support growth. Further, the reforms undertaken by the government focusing on infrastructure development, asset monetisation, taxation, telecom sector and banking sector should push up investor confidence, enhance capacity expansion and facilitate crowding in of private investment. The production-linked incentive (PLI) scheme also augurs well for domestic manufacturing and exports.

However, downside risks to growth are global semiconductor shortages, elevated commodity prices and input costs, and potential global financial market volatility. Projection for Q2 GDP growth was raised from 7.3% in the previous MPC meeting to 7.9%. Q3 projection was retained at 6.3%, and 6.1% growth was retained for Q4. The real GDP growth for Q1 2022-23 was estimated at 17.2%, which is same as the previous projection.

Given the inflation expectations and growth projections for the current financial year, it is expected that the RBI would retain its accommodative stance at least till the MPC meeting in April 2022, while maintaining the policy repo rate at 4%. However, the next step for the central bank in liquidity management would be to raise the reverse repo rate from 3.35% to 3.50% in December 2021 and 3.75% in February 2022.