Dr Debesh Roy, Chairman, InsPIRE

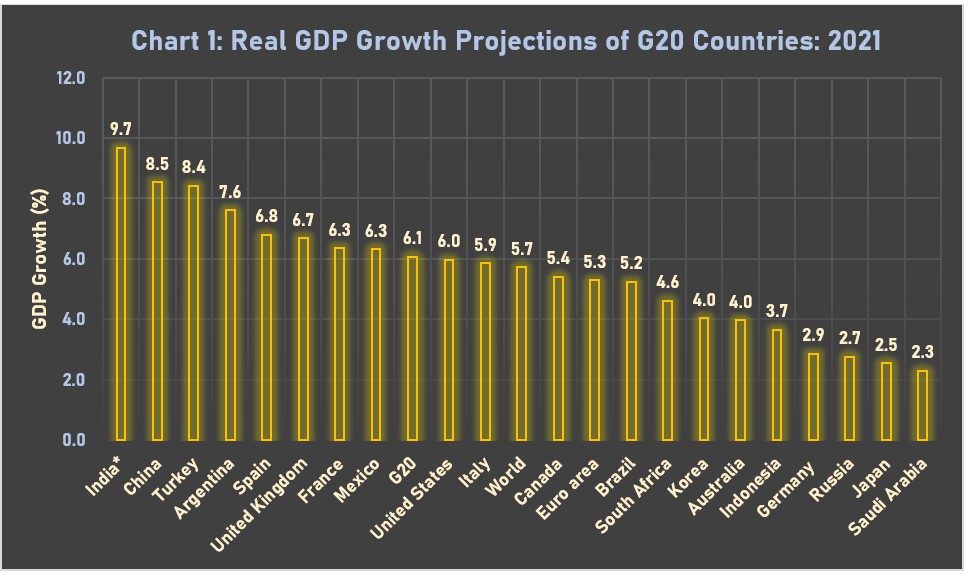

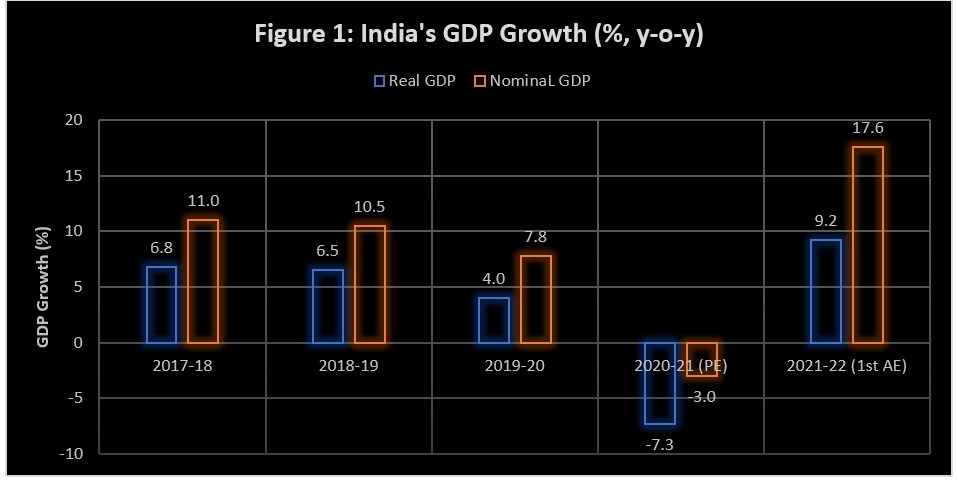

The Indian economy is poised to grow at 9.2% in FY22 (Figure 1) as per the First Advance Estimate of the country’s Gross Domestic Product (GDP) (at 2011-12 prices) estimated by the National Statistical Office (NSO), Ministry of Statistics and Programme Implementation (MoSPI), Government of India. This is against a pandemic-induced contraction of 7.3% suffered by the economy in FY21. The real GDP is estimated to increase by 1.3% over that of the pre-pandemic year (FY20).

It is pertinent to note is that, notwithstanding a favourable base effect, the economy is set to record a higher GDP compared to the pre-pandemic year FY20, due to favourable policy environment, resulting in a positive investment growth, as reflected in the Gross Fixed Capital Formation (GFCF).

The nominal GDP is set to grow at a robust 17.6% in FY 22, compared to -3.0% in FY 21. The FY22 nominal GDP, estimated at INR 232.15 trillion (USD 3.12 trillion) is expected to be 14.1% higher than that of the pre-pandemic year (FY20) at INR 203.51 trillion (USD 2.74 trillion). The economy which was on a decelerating mode during the three pre-pandemic years, (real GDP growth at 6.8%, 6.5% and 4.0% respectively during FY18, FY19 and FY20 and nominal GDP growth at 11.0%, 10.5% and 7.8%, respectively), is set to achieve a robust growth 9.2% (real GDP) and 17.6% (nominal GDP) in FY22 (Figure 1).

The real Gross Value Added (GVA) in FY22 is estimated to grow at 8.6% (Table 1). The GVA data reveals that all sectors of the economy except ‘trade, hotels, transport, communication and services related to broadcasting’ (which are still 8% below the pre-pandemic level) reached the pre-pandemic level (on constant prices).

The agriculture sector, which was the only sector unaffected by the pandemic in terms of real GVA growth in FY21, is estimated to grow steadily at 3.9%, compared to 3.6% in the previous year and 4.3% in FY20. The industrial sector is expected to achieve a robust recovery, with manufacturing; mining and quarrying; electricity, gas and water supply; and construction, set to grow at 12.5%, 14.3%, 8.5% and 10.7%, respectively (Table 1). Under the services sector, trade, hotels, transport, communication and services related to broadcasting, which was the hardest hit during the pandemic is estimated to grow at a robust 11.9%. However, financial, real estate, and professional services, etc. is estimated to grow at a less impressive 4.0%. Public administration, defence, etc. is estimated to grow at 8.6% (Table 1).

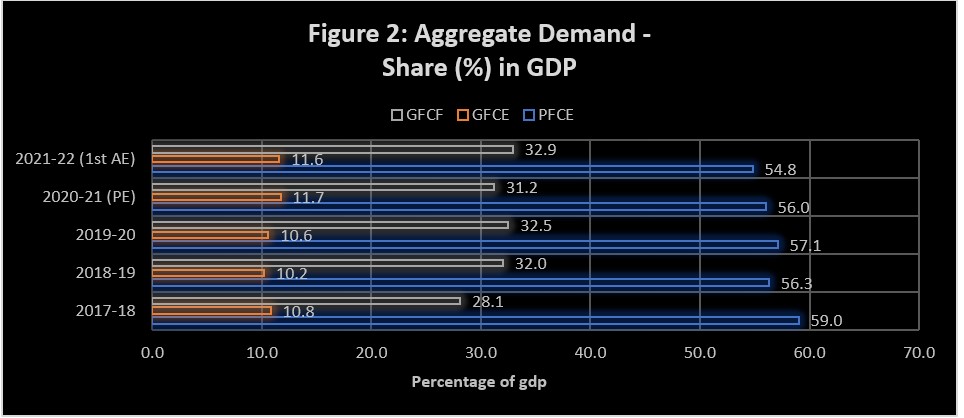

On the expenditure side, Private Final Consumption Expenditure (PFCE) is still 3% below the pre-pandemic level, and its share in GDP is observed to be on a declining trend from 57.1% in FY20, to 56% in FY 21 and further down to 54.8% in FY22 (Figure 2). This is a cause for concern as India’s growth story has essentially been a consumption led one. Loss of lives, livelihoods, jobs and income caused by the pandemic have depressed private consumption.

Another concern is the decline in the share of Government Final Consumption Expenditure (GFCE) in GDP, from 11.7% (FY21) to 11.6% (FY22) (Figure 2). A steady and sustainable growth in GDP can be sustained with a higher share of GFCE, as it crowds in private investment. While fiscal consolidation is of prime importance for attaining high, steady and sustainable growth, it is imperative to recalibrate the same to address the serious impact of the pandemic on the economy.

According to research by SBI (Ecowrap, 07 Jan, 2022), “taking into account the revised GDP figures of today, even if we consider the additional spending announced by the Government in early December 2021 fiscal deficit of the Government still comes at INR 15.88 trillion (USD 0.21 trillion) or 6.8% of the GDP. For FY23, the fiscal consolidation should remain limited to 30-40 bps from the current fiscal”.

A silver lining in the expenditure side is the increase in the share of Gross Fixed Capital Formation (GFCF) in GDP to 32.9% in FY22 (Figure 2), the highest level in the last five years. The primary driver for higher GFCF is the investments made to meet the growing pent-up demand in the economy. The focus of GoI on investment in infrastructure and the Performance Linked Incentive (PLI) Scheme, should lead to accelerated growth in investments, leading to a higher and more sustainable growth in GDP.

According to the NSO, the First Advance Estimates (FAE) of GDP, introduced in 2016-17 to serve as essential inputs to the Budget exercise, is based on limited data and compiled using the Benchmark-Indicator method i.e., the estimates available for the previous year (2020-21 in this case) are extrapolated using relevant indicators reflecting the performance of sectors.

While there could be some amount of under- or over-estimation of GDP in the FAE, the subsequent estimations, could be within 20-30 basis points, on either side. There could possibly be an upward bias in the revised estimates for FY22. However, it again depends on the impact of the prevailing omicron variant OF Covid-19 on contact-intensive sectors of the economy. Nevertheless, SBI has stuck to its estimate of 9.5% growth in FY22. Earlier estimates by RBI and IMF also point to a 9.5% growth for the Indian economy, while OECD’s estimate is a tad lower at 9.4%, which would still be higher than the growth estimates for China at 8% (IMF) and 8.1% (OECD), making India the fastest growing large economy in the world.